| Pricing |

|

|

|

|---|---|---|---|

| Per Transaction Fee | |||

|

1.70% + 30c | 1.95% + 30c | |

|

1.70% + 30c | 1.68% + 30c | |

|

1.00% + 30c | 1.00% + 30c | |

| Monthly Fee | none | none | |

| Integrations | |||

| Xero | check | check | |

| QuickBooks | close | check | |

| MYOB | close | check | |

| Sage | check | via Zapier | |

| Freshbooks | check | via Zapier | |

| Zoho Books | check | via Zapier | |

| Open API | check | check | |

| Support and service | |||

| Pre-sales help and advice | close | check | |

| Zoom workflow consultations with product team | close | check | |

| Friendly Australia based support | close | check | |

| Features/Attributes | |||

| Online credit card payments | check | check | |

| Online direct debit payments | close | check | |

| Reconciliation | Yes, but* | check | |

|

*The reconciliation with Stripe only works when invoices are processed via Xero, not coming in from elsewhere using Stripe. Additionally, surcharge fees don't reconcile completely. |

|||

| Multi-invoice / Batch Payments | close | check | |

| Instalment Payments | close | check | |

| Automated variable invoice payments | close | check | |

| On-charge fees | Yes, but* | check | |

|

*Stripe only allow you to pass on the percentage portion, not the fixed. They also don't adjust the fee to pass on, based on the card type (international etc). It's also a global setting with no per-customer override. |

|||

| Payment plans | close | check | |

| Subscriptions | Yes, but* | check | |

|

*Subscriptions are tied to a single repeating invoice cycle in Xero. So each one needs to be maintained separately. Not great when you have 1,000 subscribers. Although Stripe has a good Subscription module, it doesn't integrate / reconcile with Xero. |

|||

Just a few more of our happy customers

A partner that works with your partners

Every business has its own accounting software, and your payment platform should connect with your payments tool of choice.

Both Pinch and Stripe integrate with Xero, but Pinch is the only platform of the two that talks to Quickbooks, MYOB and Cin 7 Core. Plus, Pinch offers a unique two-way sync at no additional charge which means you always know where you stand.

- Seamless integration with leading accounting software

- Open API — the only limit is your imagination

- Two-way sync with Xero, QuickBooks, MYOB and Cin 7 Core.

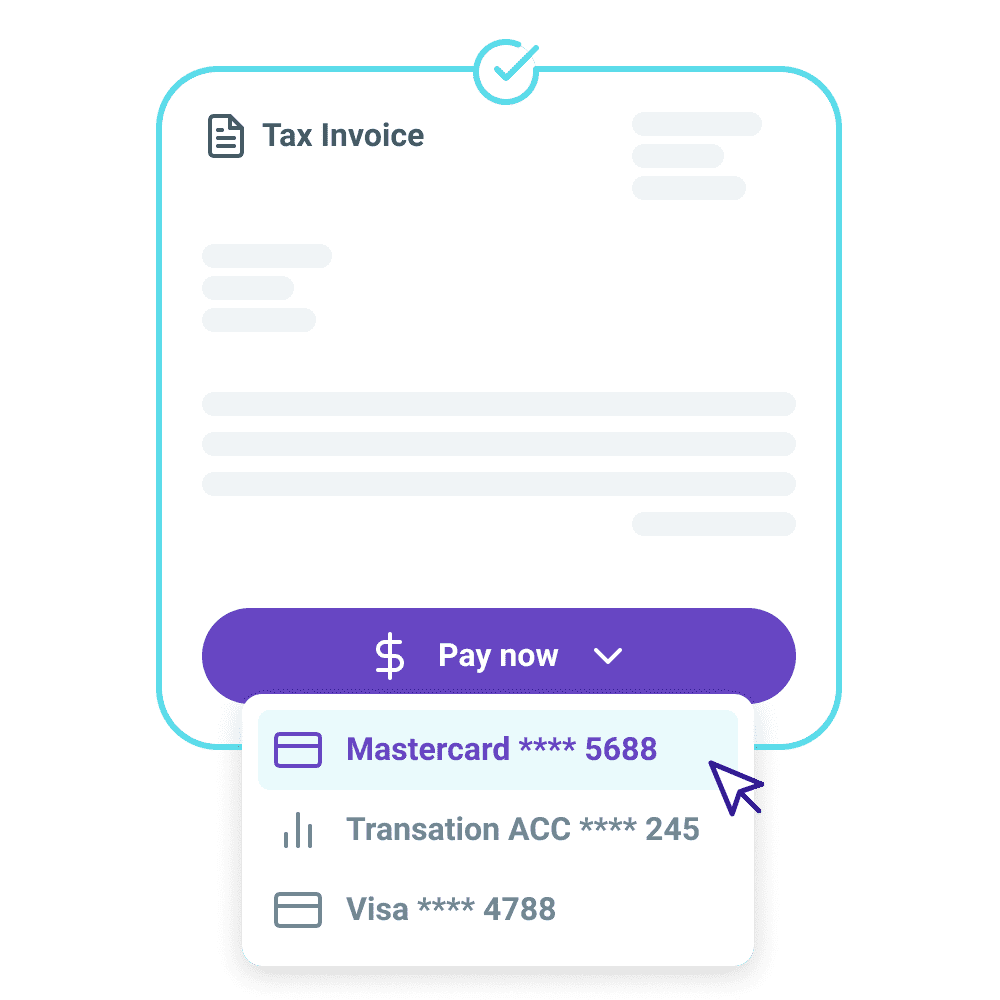

Support for direct debit and credit card payments

Pinch has the added benefit of being able to support online direct debit payments as well as credit cards.

With Pinch, your customers will have more options on how they want to pay — plus, you can choose to pass the transaction fee to your customers.

- Online credit card payments

- Securely accept direct debit payments online

- Choose to on-charge fees

Discover how countless businesses are streamlining their payments with Pinch.

Contact our Australian support team. Chat support is available during business hours, with email fallback. To figure out if we're the right solution for you, book a sales call.

Give your customers more choice over how they pay

Have clients that need to pay multiple invoices or break down big invoices into batches? Want to offer payment plans?

Your payments, your choice. Unlike Stripe, your customers have their choice of ways to pay with Pinch. Improve cash flow and give customers even more flexibility with batch payments, instalments, or by offering payment plans.

- Support for multi-invoice or batch payments

- Set up instalment payments or payment plans

- Automated variable invoice payments

What next?

Easily integrate with major accounting software or contact us for direct integration. No setup, minimum or monthly fees!