The No Late-Payment Gateway

Collect payments from invoices you send out of your accounting package

We integrate with Xero, QuickBooks Online and MYOB to allow you to collect payment from invoices you send.

Automate the collection of invoice payments, create custom payment plans to help your customers break down invoices and automate the reconciliation of every payment.

Extremely flexible custom configuration options to suit every business

How you set up your account is up to you.

Configure your own surcharging rules, payment plan options and auto-payment thresholds on a per-customer basis or set your default options and let your customers do the heavy lifting with the customer portal.

Collect more payments, and gain cash flow certainty

When you configure Pinch as your default solution and store a customer payment method for everyone you will collect more payments, and make chasing overdue payment a thing of the past.

Features

Automatically reconcile every payment you collect

Spend less time managing your bank accounts and more time on things that earn you money

When you connect your bank account to Pinch, we set up a ledger account to auto reconcile every payment you receive. Your books are always up to date - it’s as simple as that.

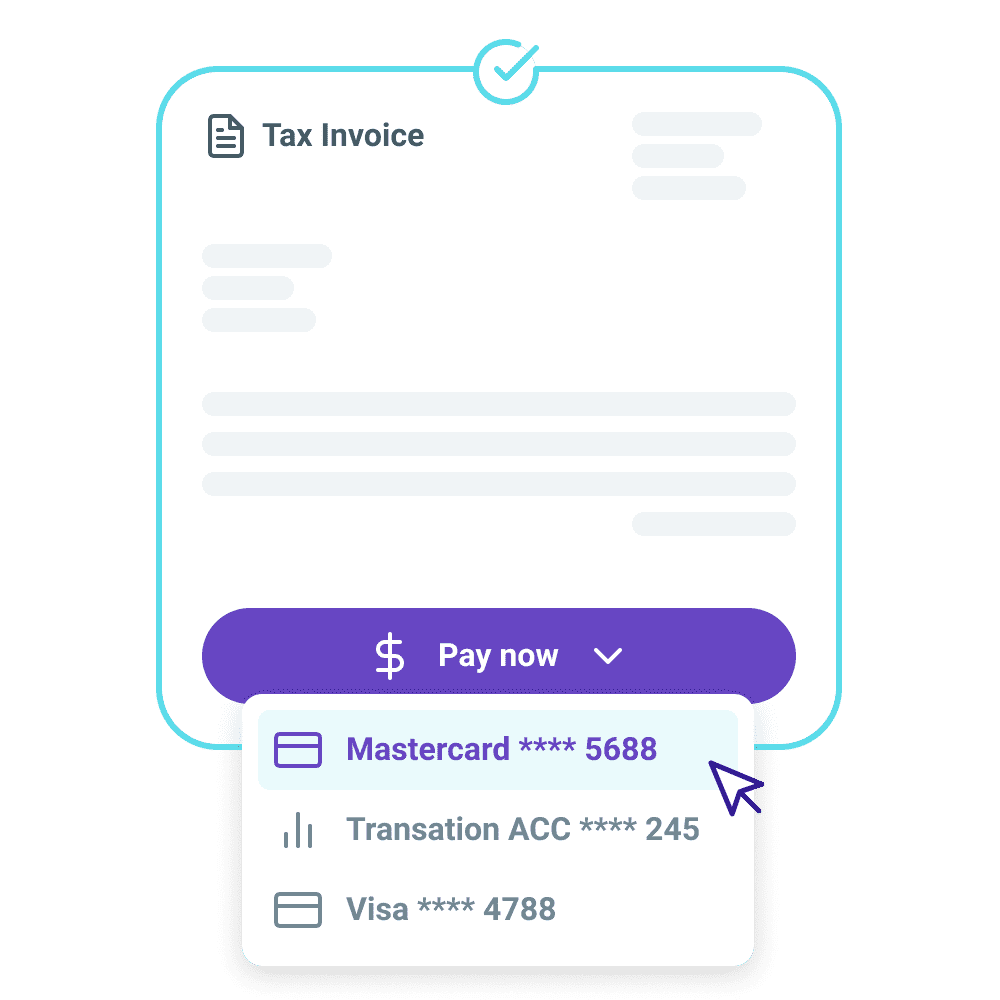

Get paid by credit or debit card, or direct debit

Accept once-off payments, variable recurring payments, payment plans, or subscriptions.

When it’s easy for your customers to pay you, they will! Offering a variety of ways for your customers to pay means they can choose the best option for them.

Get paid on-time with customer pre-approvals

Securely store customer data for automatic payments

When you create a Pre-Approval, invoices you send from your connected accounting system will be auto-paid on the invoice due date.

Pinch gives your customers more choice by enabling bank accounts and credit cards as a stored payment method, which can be completed either by you or your customer.

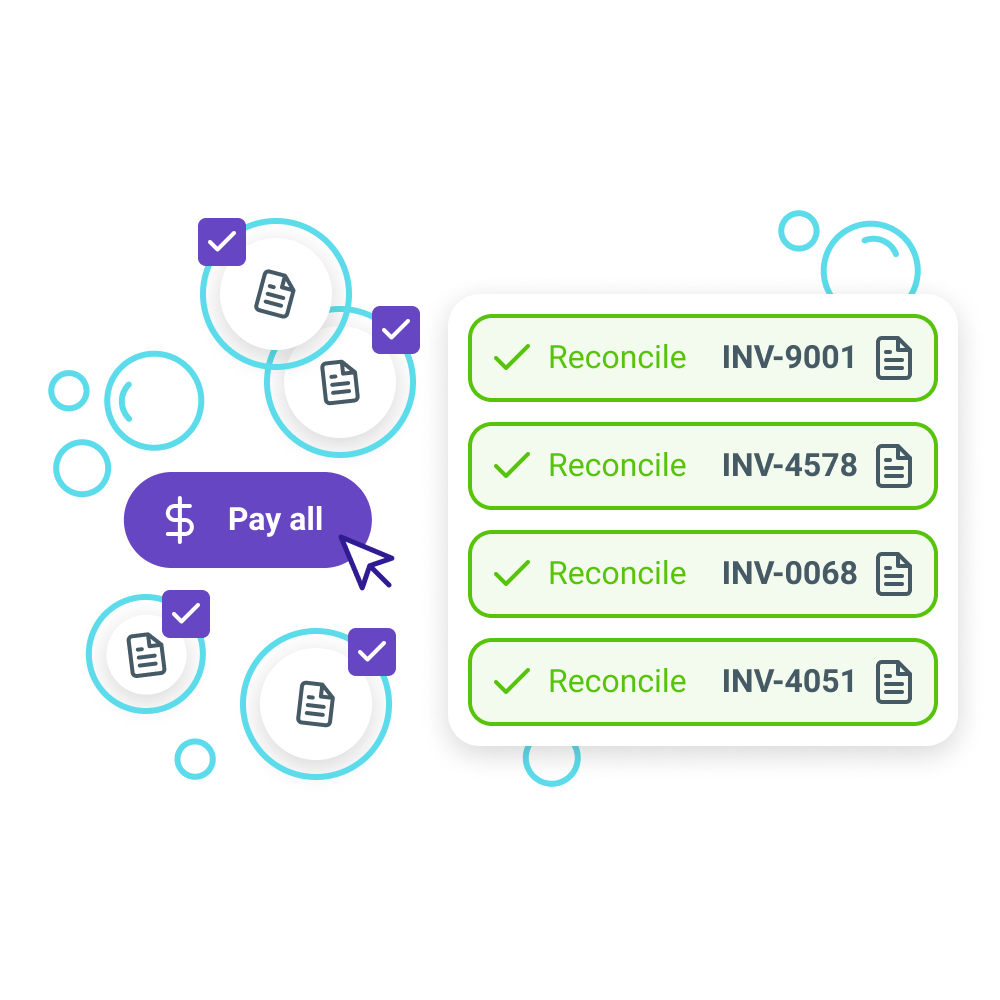

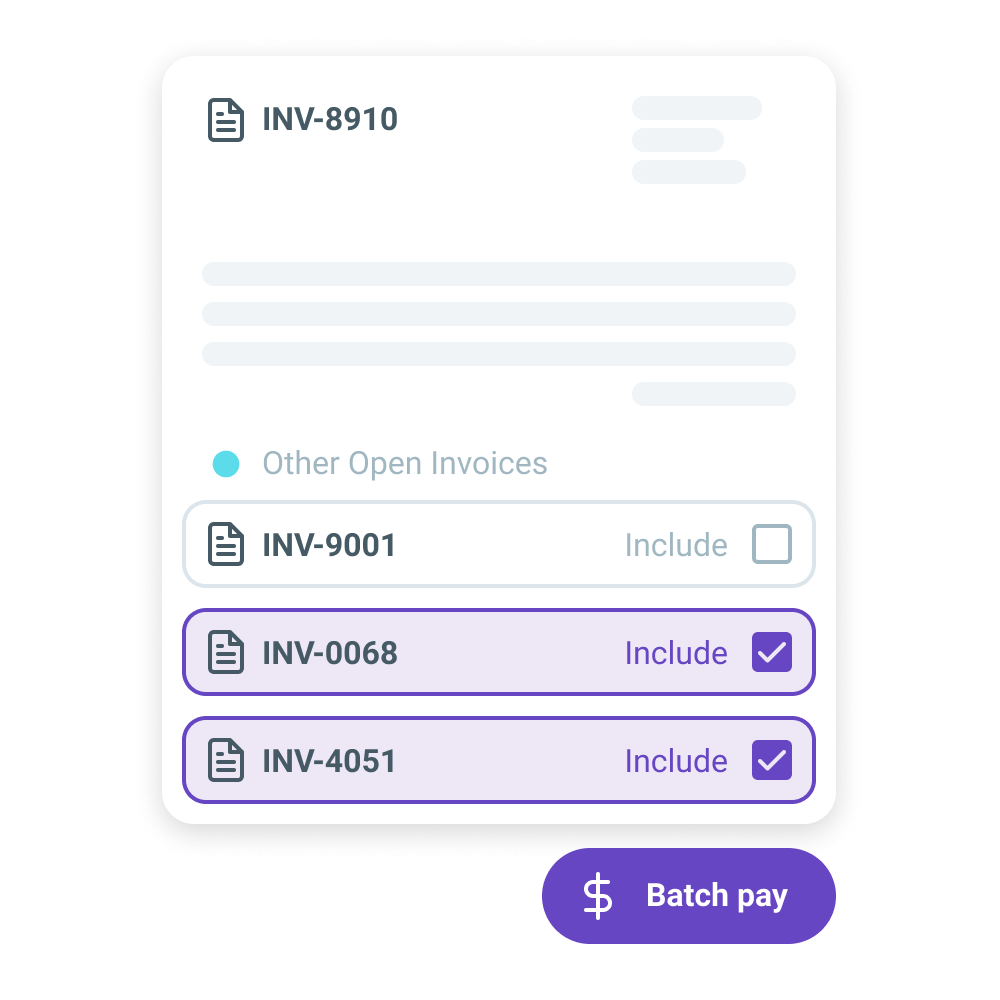

Collect multiple

payments at once

Chase customers less and boost cash flow

Customers can see all outstanding invoices every time they open an invoice from you. Batch payments are a proven way to improve cash flow and reduce bad debt.

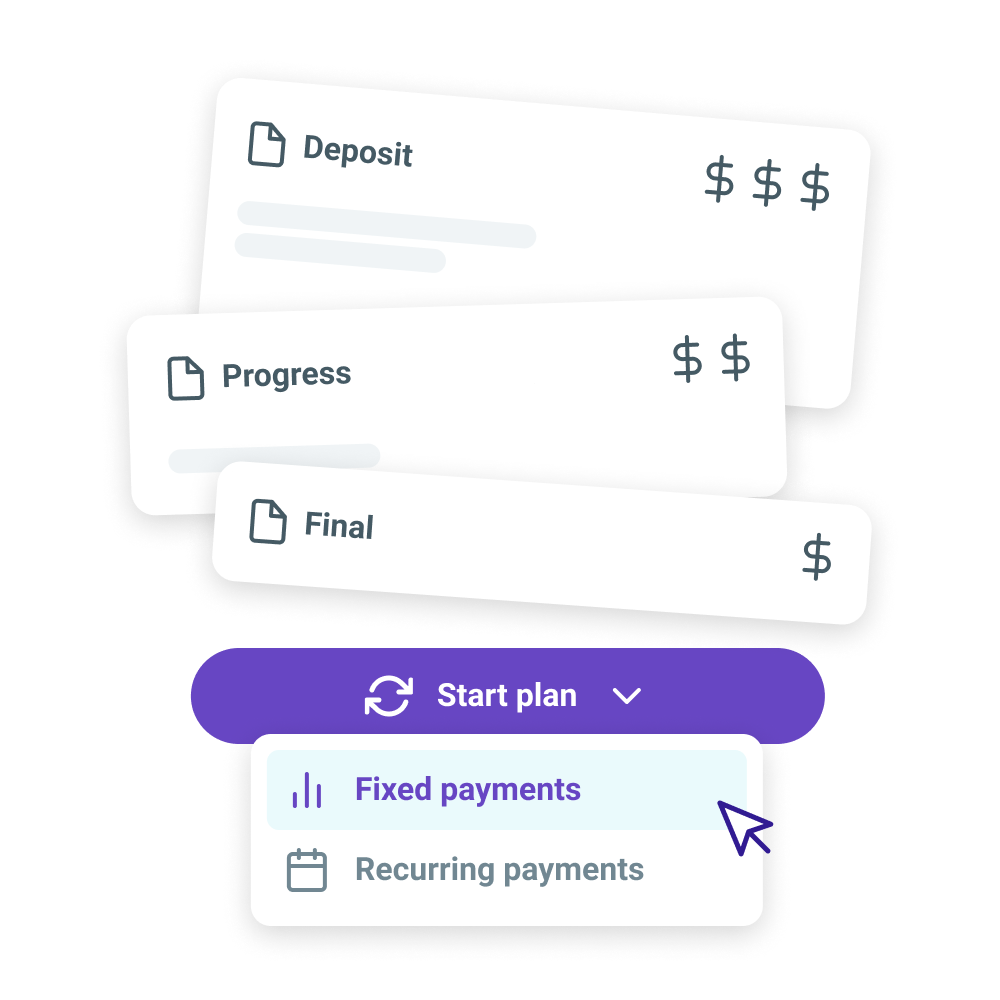

Empower your debtor management process with payment plans

Break larger invoices down into flexible payment plans with ease and make a dent in your aged debtors

Installment payments let your customers pay larger invoices in multiple smaller payments. These can be a fixed dollar amount or a percentage and are automatically reconciled in your accounting system.

A simple platform

Set up Pinch in less time than it takes to finish your morning coffee.

Pay-as-you-go-pricing

There are no set up, minimum or monthly fees. You can also on-charge transaction fees to your customers at your discretion.

Aussie support

Our Australian support team is on hand to help. Let's chat.

Automated reconciliation

When we take payment, we mark the invoice as paid and automatch the transaction with your bank feed within your accounting system.

Re-attempt payments

If a payment fails, Pinch will automatically re-attempt. We don't charge fees for re-attempting failed payments.

Safe and secure

Pinch is PCI compliant. Rest assured your customers' sensitive data is safe. We handle all of the regulations required to store card data.

Simple reporting

View your cash flow at a glance and gain insights into your business with our dashboard and transaction reporting.

Notifications

Pinch sends email notifications when attention is needed such as for failed payments and when someone enters into a pre-approval.

Shorten accounts receivable days

Reduce bad and doubtful debts with Pinch's automated invoicing and cash flow management tools. Over 1000 Aussie businesses use Pinch to reduce bad debt.

Integrations

Pinch easily integrates with major accounting software or set it up as a standalone solution.

Developer API

Psst.... are you a developer? Pinch is built API first. That means anything that we can do, you can do too! Check out more on the developer portal.

What next?

Easily integrate with major accounting software

or contact us for direct integration.