How Pinch and MYOB

work together

Pinch connects to your MYOB Essentials or AccountRight file and maintains a continuous sync of customers and invoices. When we detect that an invoice has been raised, we will automatically send an email to your customer telling them the invoice is ready. The rest is on autopilot!

Get paid with ease

The moment you approve an invoice in MYOB, the ball swings into motion to get you paid

The Pinch invoice issued notification will quickly notify your client that an invoice is due. Unlike the built in MYOB invoice link, Pinch's gateway gives your customer to option to store their payment details so you get paid automatically next time.

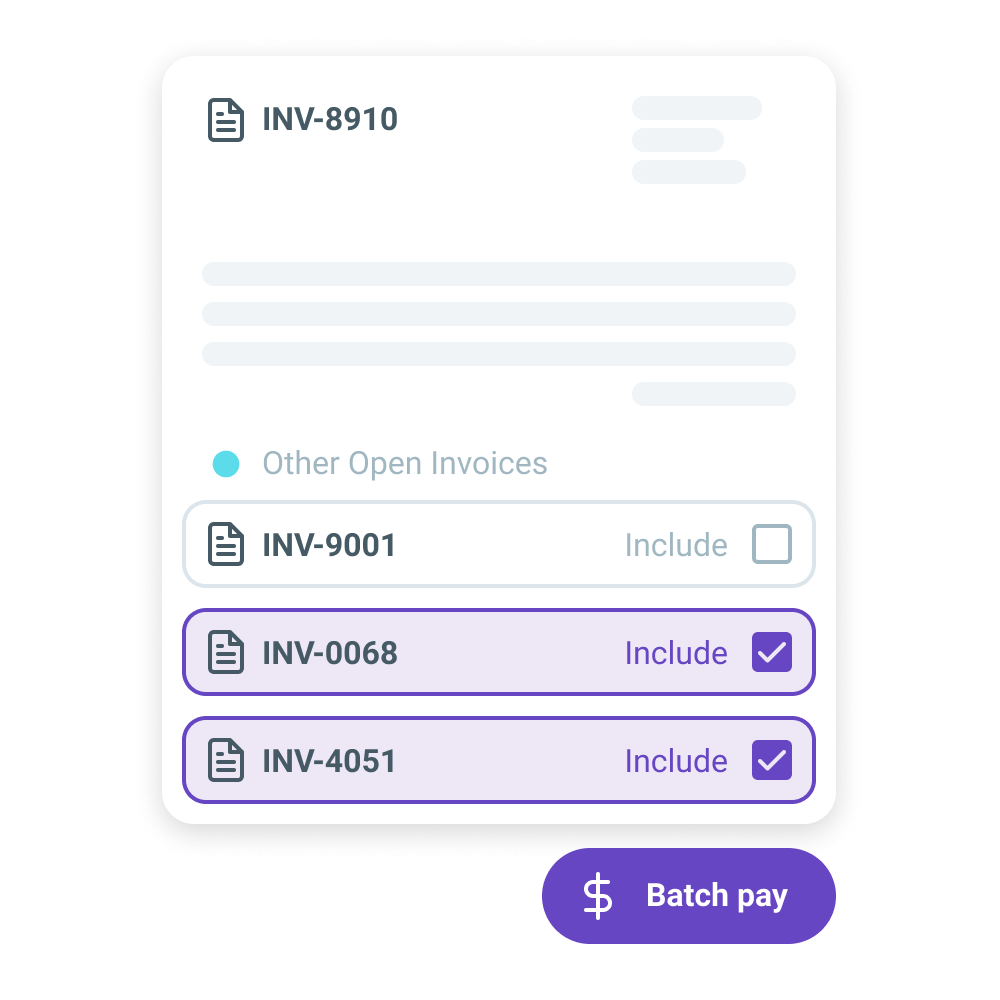

Get paid in batch

Do some of your customers have multiple invoices to pay? Now it's so much easier

Each account comes with batch payments enabled. This allows your customers to see at a glance all of the open invoices for their account. They can then select which invoices they would like to pay. Pinch will process the total in one lump sum and reconcile automatically.

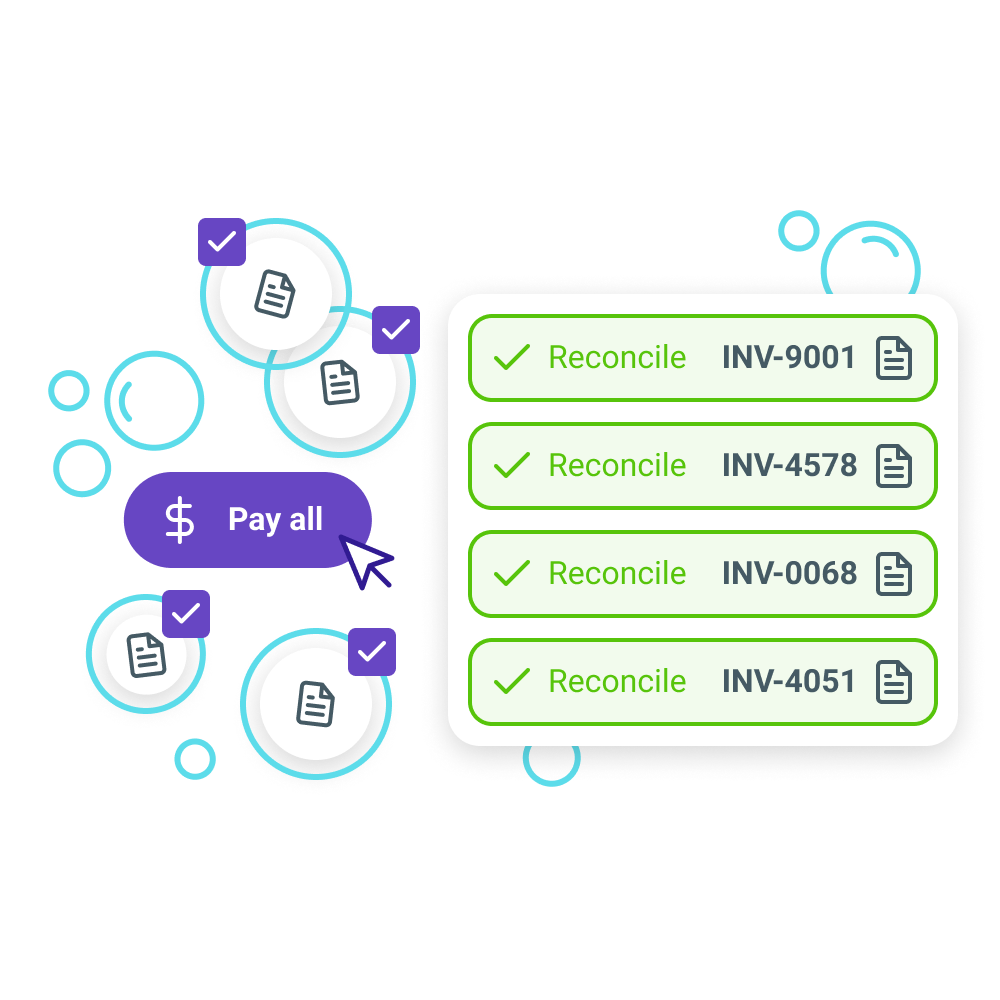

Reconcile your books

Stop reconciling invoices manually and let Pinch take care of it for you.

One of the unsung heroes of the Pinch integration is the ability to silently reconcile each invoice payment processed via Pinch with your bank feed. We set the invoice as paid in real time, then align your MYOB file with your bank statement when funds are deposited.

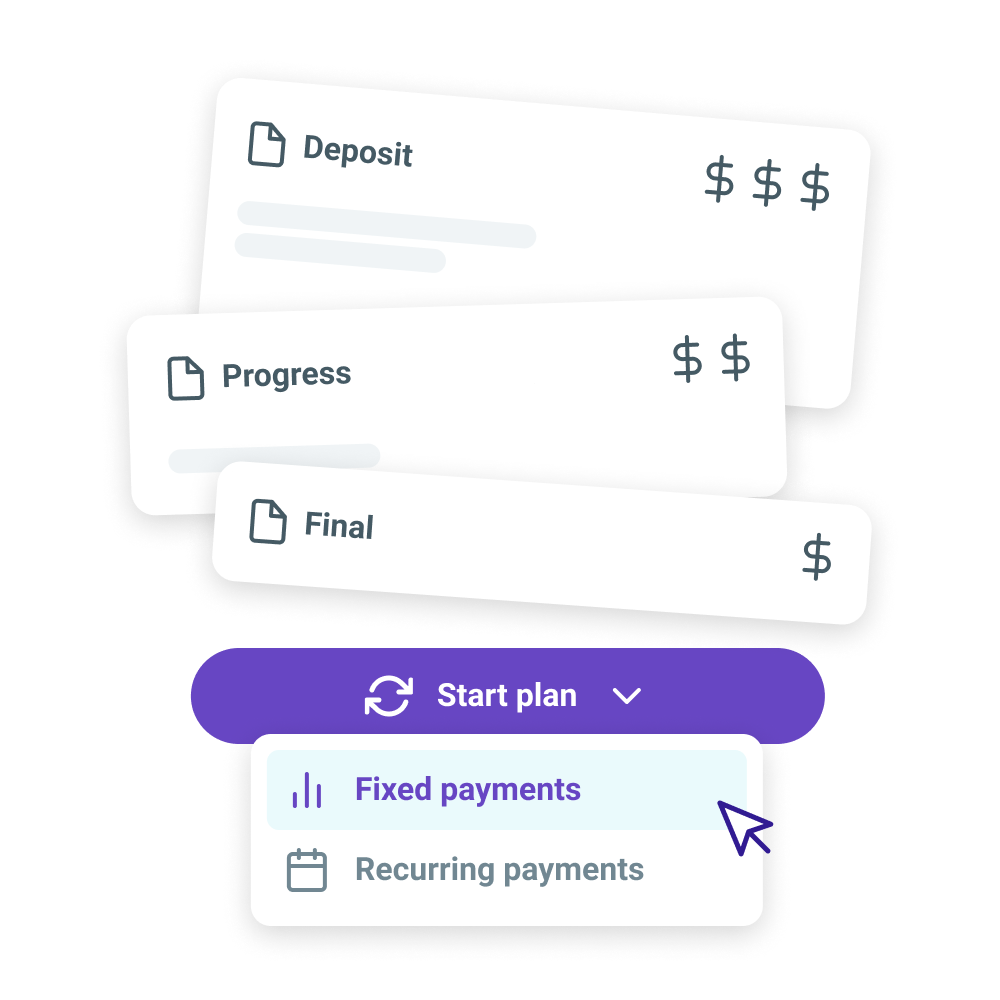

Get paid with subscriptions

Need to collect payments over time? Our plans and subscriptions module is perfect

Now you can offer free trials, initial deposits, recurring payments that end after time, number of payments, total amount paid or never ending ones! You can also break down invoices in MYOB with instalment payments that collect a certain percentage over time. Not to mention that it all just reconciles in your file automatically!

How much do I need to pay to get started?

Nothing! You only pay us when we pay you, so there is nothing to pay unless you process transactions. The worst that could happen would be a friendly call from Bill to check on how you're going!

Why use Pinch with MYOB?

Unlock powerful features by connecting Pinch to MYOB.

Pay Now

Accept one-off credit card and direct debit payments online. Take one-off payments straight from the invoice using pay now.

Recurring payments

Get paid on the invoice due date! Set up regular automatic payments like subscriptions.

Variable Payments

We can collect any ad-hoc invoice amount automatically. Set thresholds to debit smaller amounts while leaving large amounts alone.

Payment plans

Breakdown large invoices into a series of smaller payments, all tracked on the one invoice.

Batch Payments

Recover aged invoices by showing all outstanding invoices available on the pay now page.

On-charge Subscriptions

If you're paying MYOB subscription fees on behalf of your clients, you can automatically on-charge those fees using our on-charge subscription service.

What else can Pinch do?

As the complete payments platform, you can take advantage of our full range of integrations.

HubSpot Sync

Sync key information from your MYOB file directly into your HubSpot contacts. See which contacts have overdue invoices, what they've been paying, and see a timeline of activity from Pinch.

Zapier

Create your own workflows using the Pinch Zapier integration. Useful for sending pre-approval forms directly from your own email account and reacting to customers who have added their payment information.

API Integration

Pinch was built API first, which means anything that you can do in our platform, you can also connect to directly using our API.

What our customers are saying

Take a read of what our customers are saying about us

“It’s set and forget in the sense that once you onboard a client, that's it. You don't have to worry about sending an invoice again. It's just all done and dusted and it just takes away like any kind of extra people touching it or needing reminders. Before Pinch, it was always us chasing clients. Now the process is automated: we know the contract is signed, we know the payments have been audited. And then as soon as that's all done, they're put straight into our project management system. It basically minimises any room for errors, and minimises time spent chasing up and seeing where things are at.”

Kady, Kady Creative

"Pinch is an integral partner in our business. Every time I see a Pinch line on our statements, I know that it represents a lot of manual work that we’re just not doing anymore. As well as making our lives easier, it actually makes the customer journey a lot easier as well. They just have to click a button, put their card in once, and then it’s done. We’re also saving time for them in terms of theiraccounting and processing, because it’s happening automatically for them as well.

Sarah, AiRE

Gosh have just signed up with Pinch Perfect and can't believe how easy it is to setup so I can offer clients a variety of payment options...highly recommend!

Kate

It has been incredibly easy to integrate Pinch into our business and our customers have loved the flexibility to pay during hours that suit them. Pinch has made reconciliation of credit card transactions a breeze. Quick and efficient and saves a lot of time.

Nicola, OZ Excavator Buckets

Forced into looking for a change by a sudden decision by the existing provider to charge a minimum monthly fee which was 4 times what I had been paying I found and implemented Pinch. Super easy to set up and no hidebound bureaucracy such as encountered from banks. Have been using Pinch for 6 weeks and no issues to date. Particularly like the way it collects monthly subscriptions without any interaction from me. Data flows to Xero accurately and in a timely way. Would thoroughly recommend.

Stella, 1 to 1 Mobile Computer Training

The team at Pinch have been amazing and I couldn't recommend them more highly. Paul and Bill have been great in helping me setup the payments system and integrate it into my business. Always available to help and quick to pick up the phone. Thanks Pinch

David, StudentPay

Bloody love pinch! Its so simple to use and was so easy to set up. Bill and the team honestly go above and beyond and have tackled any questions or scenarios I have thrown at them. As a bookkeeper I will only be using Pinch going forward for myself and my clients.

Summer, Oh Nine Solutions

We have recently signed up with Pinch and can't believe how easy and efficiently it integrated with Xero accounts. Also love the auto-reconcile of payment fees. Pinch also makes it very easy for our clients to pay their bills. Thank you Blake for all your help. We would definitely recommend Pinch!

Valerie, Infinite Print

We've tried and tested out dozens of payment solutions over the years at Digit both with our business, and in helping other businesses move to digital payments. The team at Pinch have been amazing at finding technical solutions to meet bespoke needs. They've helped us leverage their Xero capabilities for variable billing, combined with the ability to push in through their API payer details when people sign our agreements. They're the perfect balance of automation combined with customisation, backed by a super attentive team. Can't recommend them highly enough.

Andrew, Digit Business

Get Started

Stop chasing smaller payments and automate collection using Pinch.